AI-Powered Signal-Based Relationship Management

Conducted a rapid audit of the existing platform and created a report—in 3 days

Designed and prototyped a new future-state vision of the Figma product in 3 weeks

Conducted design thinking workshops with data scientists, business subject matter experts, programmers, and senior partners

Developed task flows and user stories

Designed custom components and a functioning Figma prototype to socialize within the business

Impact

“I would have Lucas on my team again in a heartbeat. ”

SmartBanking.AI

Next Best Solutions

Credit Risk Monitoring

Attrition Risk Monitoring

Environmental, Sustainable, Governance

Context & Challenge

Many mid-tier commercial banks were the first entrants into information technology infrastructure, resources, data collection, and processes. Their systems are now in need of modernization.

But commercial banking in mid-tier banks is still largely considered a “people” business, where personal interactions between banks and client staff are customary.

The problem is there is now an overwhelming amount of data stored in multiple disparate systems and not enough people to analyze and make sense of it all.

Solution

How might we enable bank relationship managers to efficiently build client trust and manage relationships without having to manually analyze and synthesize overwhelming amounts of disparate data?

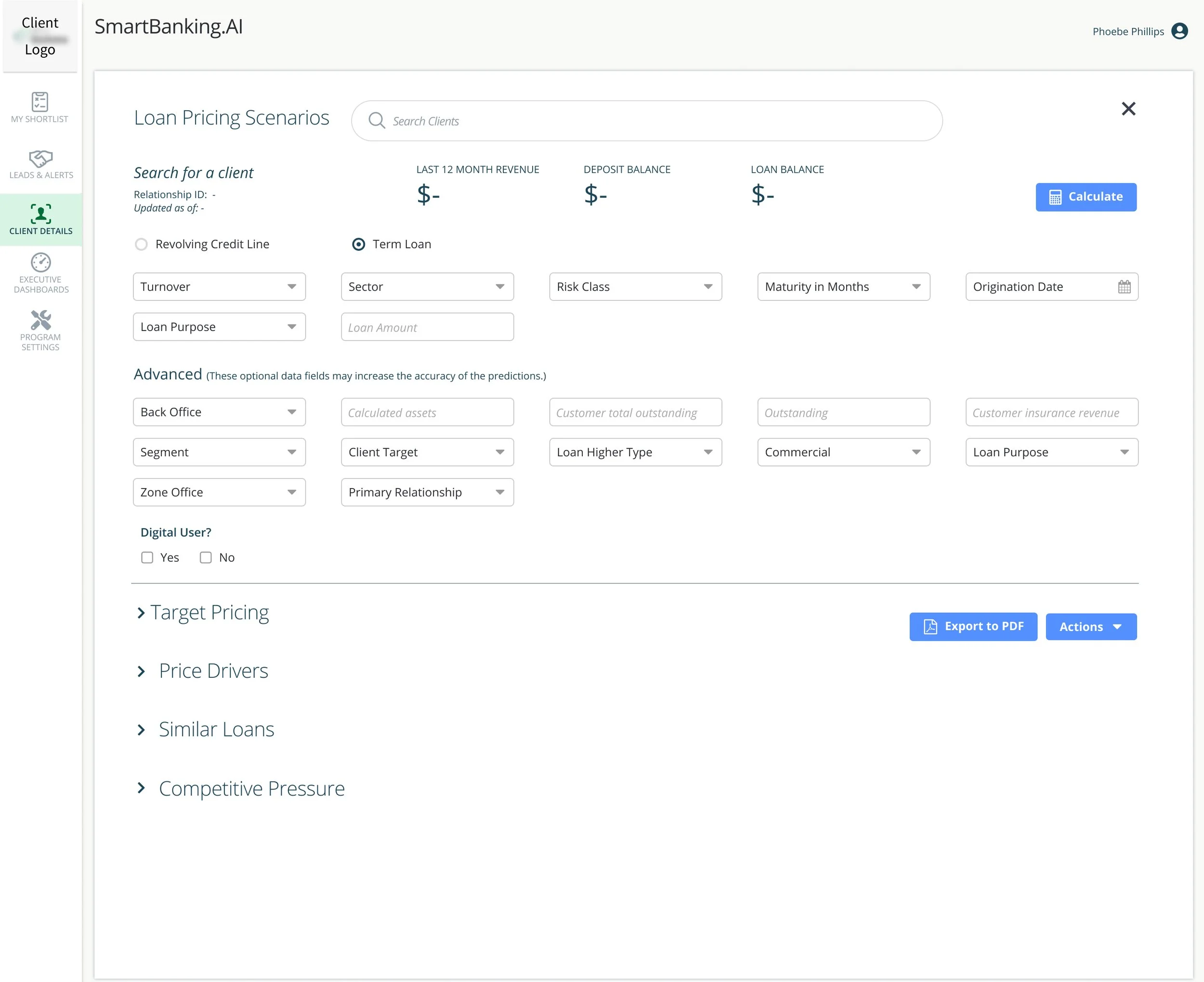

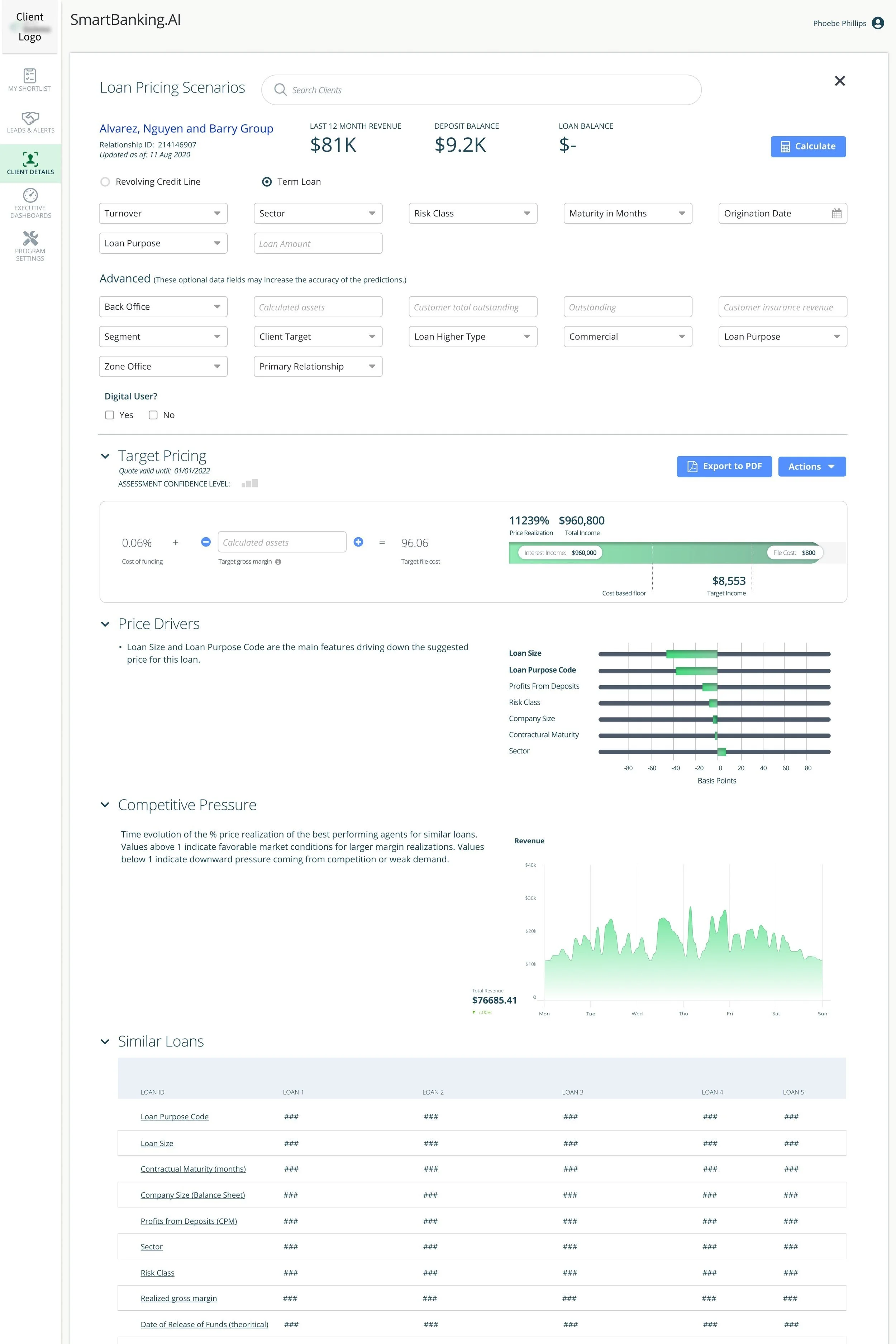

Loan Pricing Scenario Exploration

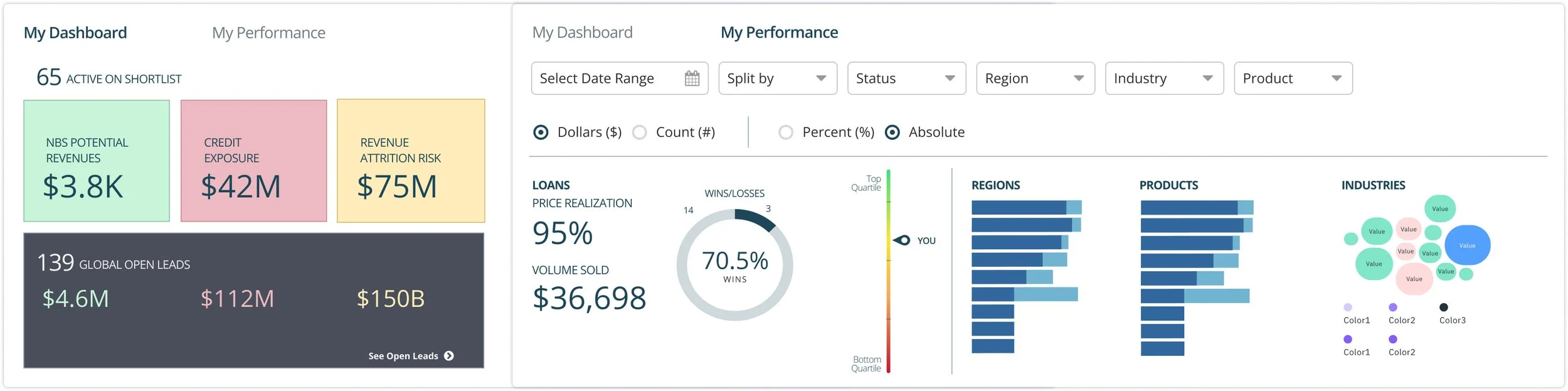

One of the main features of the Smartbanking.AI application was the ability for bankers to explore different scenarios around loan terms and pricing that used specific data about each individual person, in real-time. It effectively created personalized 1:1 targeted pricing that was optimized for both revenue generation and the probability that a customer would accept the price and terms.

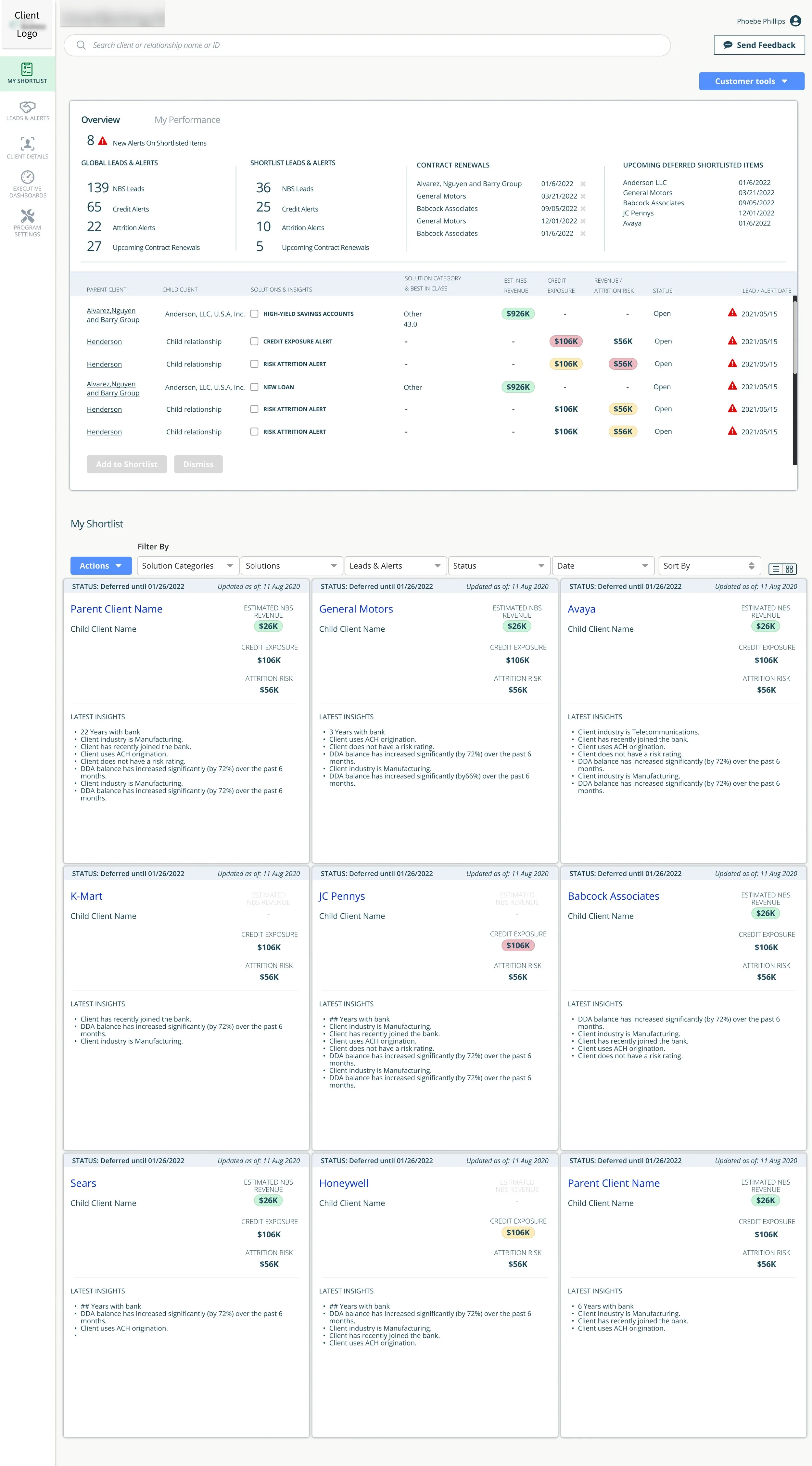

Shortlist Leads & Alerts

Being able to manage their signals, leads, and alerts, is critical for bankers to make effective use of their time and effort. The application can alert the banker to the most high-value potential leads, attrition prone accounts, and clients with credit overexposure. This feature increases the bankers “value per interaction” for each client.